Libya oil and gas companies stand as a cornerstone of the nation’s economy, holding a wealth of potential that continues to intrigue global energy markets. As we delve into the dynamics of Libya’s energy industry, we find a landscape shaped by rich reserves and strategic geopolitical positioning. Despite facing complex challenges, Libya’s oil and gas companies remain pivotal in driving economic growth and fostering international partnerships.

In recent years, Libya has navigated a turbulent path, yet its commitment to revitalising the energy sector is unwavering. The nation’s oil and gas companies are not just critical revenue generators; they’re also key players in stabilising the region’s economic future. By exploring the strategies and developments within these companies, we gain insights into their role in both domestic and international spheres. As we examine the intricacies of this vital industry, we uncover the resilience and potential that define Libya’s energy landscape.

Table of Contents

Overview Of Libya’s Oil And Gas Sector

Libya’s oil and gas sector plays a pivotal role in the national economy, contributing substantially to GDP. As one of Africa’s largest oil producers, Libya holds proven reserves exceeding 48 billion barrels. The sector, primarily managed by the National Oil Corporation (NOC), is essential to the country’s economic stability and growth.

Foreign companies partner with local entities to explore and diversify production capabilities. This collaboration, though faced with geopolitical and infrastructural challenges, remains critical for modernising the industry.

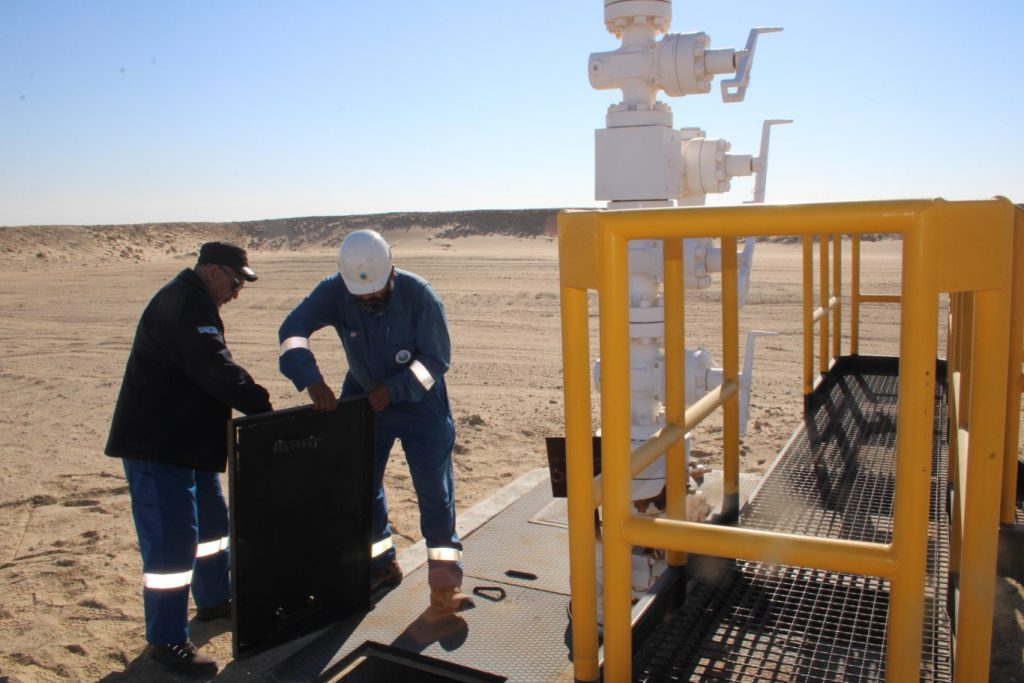

Efforts to improve operational efficiency and safety standards continue to shape industry practices. Companies focus on optimising exploration, production, and transportation processes to maximise output.

The investment landscape in Libya requires careful navigation due to evolving regulatory frameworks. Strategic partnerships, such as those embodied by entities like Qabas in Tripoli, offer essential insights and services. These firms guide stakeholders through complexities, providing expertise in risk management, strategy, and training.

Technological advancements present opportunities to increase productivity within the sector. Adopting cutting-edge solutions enhances resource management and drives industry innovation. Overall, the Libyan oil and gas sector stands resilient and poised for growth, supported by a combination of local and international expertise.

Key Players In The Industry

Libya’s oil and gas sector relies on crucial players who drive its growth and stability. These entities are instrumental in navigating economic and geopolitical challenges while ensuring progress.

National Oil Corporation (NOC)

The National Oil Corporation (NOC) plays a central role in Libya’s energy landscape. Tasked with managing the country’s vast oil and gas reserves, NOC oversees exploration and production activities. Its efforts to enhance operational efficiency and safety are vital for maintaining output levels. NOC’s collaborations with international partners aim to augment technological solutions, crucial for overcoming infrastructural and regulatory challenges. By fostering strategic alliances, NOC contributes significantly to stabilising Libya’s economy and fostering growth.

International Oil Companies

Several international oil companies significantly impact Libya’s oil and gas industry. These entities bring investment and expertise, essential for expanding production capabilities and improving technology use. Despite geopolitical tensions, companies like Eni, TotalEnergies, and BP persist in their commitment to the Libyan market. Their presence highlights the sector’s resilience and potential for innovation. By working alongside NOC, these companies ensure a diversified energy portfolio, strengthening Libya’s position in global markets.

Such intricate dynamics present an intriguing yet complex landscape for consulting firms in Tripoli. We leverage our deep industry knowledge to help organisations like NOC navigate this complexity with precision, creating value and ensuring long-term success. As Libya’s industry progresses, our focus on strategic operations and risk management becomes indispensable, offering a comprehensive understanding aligned with market needs and regulatory requirements.

Economic Impact Of Oil And Gas

Libya’s oil and gas sector acts as a cornerstone of its economy. This pivotal industry not only generates substantial revenue but also drives various economic facets.

Contribution To GDP

The oil and gas sector represents a significant portion of Libya’s GDP. As one of Africa’s top oil producers, Libya relies heavily on hydrocarbon exports to fuel economic activities. The revenues derived from oil and gas have been instrumental in funding public services, infrastructure projects, and social programmes. By attracting foreign investment and fostering development, the industry supports sustainable economic growth.

Employment Opportunities

The sector also serves as a key employment engine within Libya. Directly and indirectly, it provides jobs for thousands in fields like exploration, production, transportation, and refining. Local workforce development is enhanced through partnerships with international firms offering training and skills acquisition. As operational challenges are navigated, employment opportunities can further expand, bolstering economic resilience.

Qabas, leveraging its strategic expertise, assists organisations in maximising the economic impacts of their ventures. Through effective risk management and operational strategies, we enhance the capacity of Libya’s oil and gas sector.

Challenges Facing Libya Oil And Gas Companies

Libya’s oil and gas companies face significant challenges that impact their operations and strategies. Political instability and infrastructure issues are major hurdles that these companies navigate in their quest for growth and resilience.

Political Instability

Political instability significantly affects Libya’s energy sector, complicating operations and decision-making for oil and gas companies. Frequent changes in government and the ongoing conflict disrupt oil production and create uncertainties in policy implementation. These fluctuations prevent consistent strategic planning, deterring both local and international investors from fully engaging with Libya’s rich resources. Firms like ours, based in Tripoli, excel in developing strategies to manage and mitigate risks posed by such instabilities, offering essential guidance in this volatile environment.

Infrastructure Issues

Infrastructure issues pose further challenges to Libya’s oil and gas companies. Damaged pipelines and outdated technology hinder efficient production and distribution, reducing the sector’s overall output. The lack of investment in infrastructure improvements stems from the multifaceted political landscape and impacts operational continuity. Enhancing infrastructure requires modernisation and adherence to safety standards to meet global demands. Our firm plays a critical role in identifying infrastructure vulnerabilities and providing bespoke solutions to optimise performance and ensure resilience against external disruptions.

Future Prospects For The Industry

Libya’s oil and gas sector has significant growth potential. With strategic focus and partnerships, the industry can navigate existing challenges to realise these opportunities.

Exploration And Development

New discoveries have the potential to boost Libya’s oil reserves significantly. Enhanced exploration activities, particularly in untapped regions, offer promising prospects. Development of existing fields, using cutting-edge technologies, increases productivity and efficiency. As exploration ventures expand, aligning regulatory frameworks and ensuring stability will be crucial.

Investment Opportunities

The sector offers numerous investment opportunities despite geopolitical tensions. Engaging international stakeholders can facilitate technological exchanges and strengthen infrastructural capabilities. Partnering with global companies encourages knowledge transfer and resource optimisation. Strategic investments in modernisation and safety systems demonstrate long-term economic resilience and potential.

Conclusion

Libya’s oil and gas sector stands as a pillar of economic stability and growth, with its vast reserves and strategic partnerships offering a foundation for future prosperity. While challenges such as political instability and infrastructure issues persist, the resilience and commitment of key players like the NOC and its international partners are evident.

By embracing technological advancements and focusing on strategic risk management, the industry is poised to navigate its complex landscape successfully. Our collective efforts in enhancing operational efficiency and modernising infrastructure will be crucial in unlocking the full potential of Libya’s energy sector.

As we continue to foster foreign partnerships and explore untapped regions, the opportunities for growth and innovation remain significant. The path forward requires a concerted focus on aligning with market needs and regulatory requirements, ensuring that Libya’s oil and gas industry remains a robust contributor to the nation’s economic future.

Frequently Asked Questions

Why is Libya’s oil and gas sector important to its economy?

Libya’s oil and gas sector is a cornerstone of its economy, contributing significantly to the GDP and funding essential public services and infrastructure projects. With over 48 billion barrels of proven reserves, the sector is a major employment source and drives Libya’s economic resilience. Revenues generated from oil and gas are crucial for economic stability and growth, making this industry vital for the nation’s future.

What challenges does Libya face in the oil and gas industry?

Key challenges include political instability and infrastructure issues. Frequent government changes and conflict disrupt production and deter investment. Damaged pipelines and outdated technology hinder production and distribution, necessitating modernisation and improved safety standards to ensure efficient operations and performance.

How do foreign partnerships impact Libya’s oil and gas sector?

Foreign partnerships are crucial for diversifying production capabilities and enhancing technological solutions. Collaborations with international oil companies like Eni, TotalEnergies, and BP help expand production capabilities and drive innovation, aiding in the navigation of geopolitical and infrastructural challenges.

What role does the National Oil Corporation (NOC) play in Libya’s energy sector?

The NOC manages the exploration and production activities of Libya’s oil and gas industry, overseeing the sector’s growth and stability. It collaborates with international companies for technological advancements and production expansion, playing a central role in the country’s economic landscape.

How is Libya improving operational efficiency in the oil and gas sector?

Efforts to boost operational efficiency include modernising infrastructure, adopting cutting-edge technologies, and enhancing safety standards. By focusing on strategic operations and risk management, Libya aims to align its energy sector with evolving regulatory requirements and market demands, ensuring long-term success.

What future prospects exist for Libya’s oil and gas industry?

The sector holds significant growth potential with enhanced exploration activities in untapped regions and development of existing fields using advanced technologies. Despite geopolitical tensions, there are numerous investment opportunities, and international engagement is expected to facilitate technological exchanges and infrastructure strengthening.

How do consulting firms like Qabas support Libya’s oil and gas sector?

Consulting firms like Qabas provide strategic expertise in risk management and operational strategies, helping Libya navigate challenges and enhance its oil and gas capacity. These firms assist in maximising economic impacts of ventures and ensuring resilience against disruptions, contributing to the sector’s growth and stability.