This article offers an in-depth exploration of the Central Bank of Libya (CBL), delving into its core functions, key website sections, and essential information for those with an interest in Libya’s financial and monetary systems.

By the end of this piece, you will not only be familiar with the Central Bank of Libya but also possess a deep understanding of its operations, governance, and strategic initiatives.

This guide is designed to equip you with detailed knowledge, making you well-informed about the institution’s pivotal role in shaping Libya’s economic landscape.

Table of Contents

Overview of the Libyan Central Bank

The Central Bank of Libya is the pivotal institution in the country’s financial sector, charged with maintaining monetary stability and overseeing financial operations. Established to regulate and manage the national currency, the CBL ensures economic stability through prudent monetary policies and robust financial oversight.

The institution’s mission focuses on sustaining economic growth and ensuring the integrity of the financial system, while its vision encompasses fostering a resilient and progressive financial environment conducive to national development.

Core functions of the Central Bank of Libya include:

- Monetary Policy Implementation: Controlling inflation and stabilising the Libyan dinar through strategic monetary policies.

- Financial Stability Assurance: Overseeing the financial system to prevent crises and ensure a stable economic environment.

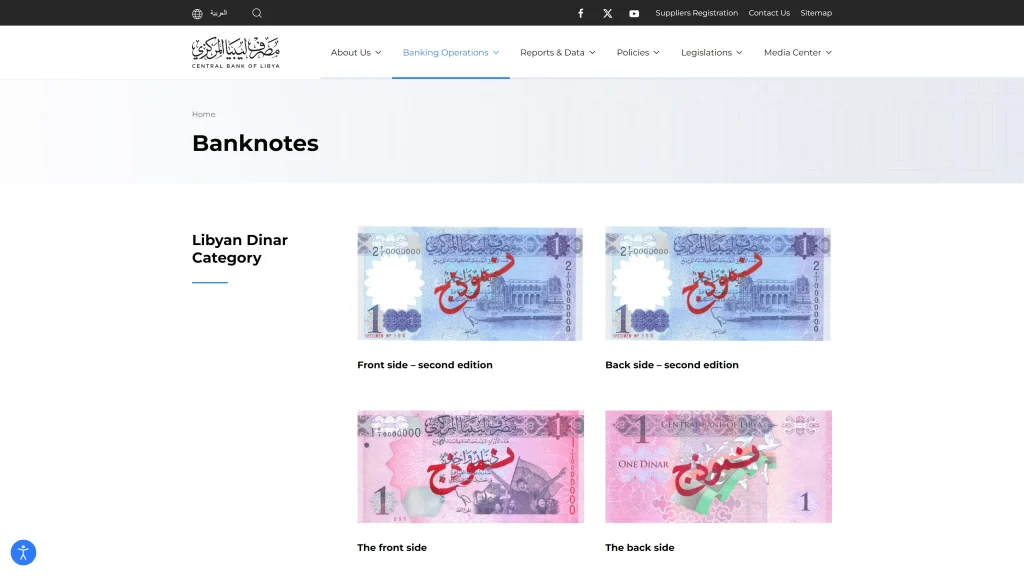

- Currency Issuance and Management: Regulating the issuance, design, and management of the national currency, including implementing security features to combat counterfeiting.

- Banking Sector Supervision: Enforcing compliance with financial laws and regulations to maintain the soundness and integrity of the banking sector.

Governance and Organisational Structure

The governance of the Central Bank of Libya is designed to ensure accountability and effective management. More specifically, it is structured in the following way:

- Senior Management: Led by the Governor, Sadiq Omar Al-Kabir, senior management oversees the strategic direction and overall management of the bank. The Governor is supported by the Deputy Governor, Marai Muftah Salim, who assists in policy implementation and administrative oversight. The Board of Directors plays a crucial role in setting policies and strategic direction, ensuring that the bank’s objectives are met. This governing body is responsible for making critical decisions and providing guidance on key financial and operational matters.

- Administrative and Financial Services Sector: This sector manages human resources, financial services, and administrative support. It defines job roles, provides administrative support, and ensures staff development. The sector is responsible for creating a productive work environment and managing the financial logistics of the bank, ensuring that resources are efficiently allocated and managed to support the bank’s operations.

- Banking Operations Sector: Central to the execution of the CBL’s banking and financial procedures, this sector oversees the modernisation of payment systems, integrating electronic banking solutions to improve transaction efficiency and security. It also manages currency circulation, ensuring that banknotes and coins are of high quality and sufficiently available. Streamlining work procedures to enhance service delivery is a primary focus, aiming to improve the efficiency of banking operations.

- Supervision Sector: This sector maintains the stability and integrity of the banking system in Libya. It monitors and evaluates the performance of financial institutions, ensuring compliance with both national and international standards. The sector reviews banking policies and supervises the financial health of banks, focusing on liquidity and adherence to CBL regulations. Its oversight is crucial for fostering a stable and reliable banking environment, essential for economic stability.

- Financial and Monetary Stability Sector: Responsible for implementing and managing monetary policies, this sector controls inflation, stabilizes exchange rates, and regulates interest rates. It conducts economic research to inform policy decisions and develops tools to manage monetary policy effectively. By focusing on these areas, the sector supports the broader economic objectives of Libya, ensuring financial stability and fostering economic growth.

Strategic Initiatives and Programs

The CBL undertakes several strategic initiatives to promote economic stability and growth. More specifically, these include:

- Financial Inclusion: One of the CBL’s strategic goals is to increase financial inclusion, ensuring that a larger proportion of the population has access to banking and financial services. This involves initiatives to promote digital banking, expand branch networks, and support microfinance institutions.

- Payment Systems Modernisation: The CBL is actively working to modernise Libya’s payment systems. This includes upgrading infrastructure to facilitate secure and efficient electronic transactions, thus reducing reliance on cash and improving overall financial efficiency.

- Digital Banking Innovations: Embracing technological advancements, the CBL supports the development and implementation of digital banking solutions. This aims to enhance service delivery, improve customer experience, and foster a more inclusive financial environment.

- Economic Stabilisation Programs: The CBL implements various programs aimed at stabilising the economy, particularly during times of financial crisis. These programs include liquidity support for banks, interest rate adjustments, and foreign exchange interventions to maintain the value of the Libyan dinar.

Research and Development

The CBL places significant emphasis on research and development to inform its policy decisions. Through its Research and Statistics Department, the bank conducts detailed studies on various economic indicators, financial stability, and market trends.

These research activities are crucial for developing data-driven policies that support the bank’s objectives, and are ariculated as follows:

- Monetary Policy Research: This involves studying the impacts of different monetary policies on inflation, employment, and economic growth. The insights gained from this research help the CBL to implement effective strategies to achieve its macroeconomic objectives.

- Financial Market Analysis: The CBL analyses financial market trends and dynamics to understand their implications for the banking sector and overall economic stability. This research supports the development of policies that enhance market efficiency and stability.

- Economic Forecasting: The bank employs advanced econometric models to forecast economic conditions and trends. These forecasts are essential for proactive policy-making and strategic planning.

FAQs about the Central Bank of Libya

What is the role of the Central Bank of Libya?

The Central Bank of Libya acts as the monetary authority in Libya, overseeing monetary policy, managing the country’s foreign exchange reserves, issuing currency, and supervising the banking sector.

What currency is used in Libya?

The currency used in Libya is the Libyan Dinar (LYD). It is issued and regulated by the Central Bank of Libya.

How does the Central Bank of Libya influence the economy?

The Central Bank of Libya influences the economy through various means, including setting interest rates, controlling money supply, regulating the banking sector, and managing the country’s foreign exchange reserves.

Who are the current leaders of the Central Bank of Libya?

As of 10 June 2024, the Governor of the Central Bank of Libya is Al-Siddiq Omar Al-Kabir, and the Deputy Governor is Mari Miftah Salem.

What are the responsibilities of the Central Bank of Libya in managing foreign exchange?

The Central Bank of Libya manages the country’s foreign exchange reserves, authorizes the sale of foreign currency to importers through letters of credit, and maintains the official exchange rate of the Libyan Dinar.

How has the Central Bank of Libya dealt with economic challenges?

During periods of conflict, the Central Bank of Libya has managed economic challenges by controlling government spending, regulating the sale of hard currency, and addressing issues such as cash shortages and currency exchange rates.

What measures has the Central Bank of Libya taken to modernise and develop?

Following the issuance of Law No. (1) of 2005 regarding banks, the Central Bank of Libya has prepared a strategic plan to modernise its structure and performance. This includes developing its institutional and functional levels, improving internal control systems, enhancing employee capabilities, and updating its information technology systems.

What is the history of the Central Bank of Libya?

The Central Bank of Libya was established in 1956 to serve as the primary financial institution responsible for the country’s monetary policy, financial regulation, and economic management.

What are the main functions of the Central Bank of Libya?

The main functions of the Central Bank of Libya include issuing currency, implementing monetary policy, regulating the banking system, managing foreign exchange reserves, and ensuring financial stability.

What challenges has the Central Bank of Libya faced in recent years?

The Central Bank of Libya has faced significant challenges, including economic instability due to conflict, issues with currency regulation, managing cash shortages, and dealing with the disparity between official and black market exchange rates.

How does the Central Bank of Libya support financial stability?

The Central Bank of Libya supports financial stability by regulating the banking sector, ensuring sufficient liquidity in the banking system, managing inflation, and implementing measures to maintain the stability of the Libyan Dinar.

What is the official exchange rate policy of the Central Bank of Libya?

The Central Bank of Libya maintains a fixed exchange rate policy for the Libyan Dinar and authorizes the sale of foreign currency through letters of credit to manage the exchange rate and foreign currency availability.

How does the Central Bank of Libya issue currency?

The Central Bank of Libya is responsible for issuing Libyan Dinar banknotes and coins, ensuring they are available to meet the needs of the economy and replacing damaged or old currency.

How has the Central Bank of Libya addressed issues with the black market?

The Central Bank of Libya has taken measures to address the black market by regulating the sale of foreign currency, setting exchange rate policies, and implementing controls to reduce currency speculation and fraud.

What is the importance of letters of credit in Libya’s economy?

Letters of credit are crucial in Libya’s economy as they facilitate the importation of goods by allowing businesses to obtain foreign currency at the official exchange rate.

How does the Central Bank of Libya manage inflation?

The Central Bank of Libya manages inflation through monetary policy measures, including controlling money supply, setting interest rates, and implementing policies to stabilise prices.

What measures has the Central Bank of Libya taken to combat economic fraud?

The Central Bank of Libya has implemented regulatory measures, conducted audits, and collaborated with other government entities to combat economic fraud, particularly in the issuance and use of letters of credit.

How has the Central Bank of Libya handled the liquidity crisis?

The Central Bank of Libya has managed the liquidity crisis by regulating cash flow within the banking system, ensuring banks have sufficient liquidity, and implementing policies to address cash shortages.

What strategic initiatives has the Central Bank of Libya undertaken recently?

The Central Bank of Libya has embarked on several strategic initiatives, including modernising its institutional and functional levels, developing its monitoring and supervisory capabilities, enhancing its monetary policy tools, and upgrading its information technology systems.

What is the impact of the Central Bank of Libya’s policies on the economy?

The policies of the Central Bank of Libya significantly impact the economy by influencing inflation rates, stabilising the national currency, ensuring financial stability, and facilitating economic growth through effective monetary policy.

How does the Central Bank of Libya ensure compliance with international standards?

The Central Bank of Libya ensures compliance with international standards by adhering to best practices in banking supervision, implementing international accounting standards, and maintaining transparency and disclosure in its operations.

What is the significance of the Central Bank of Libya’s strategic plan?

The strategic plan of the Central Bank of Libya is significant as it aims to modernise the bank, improve its efficiency, enhance its regulatory framework, and strengthen its role in ensuring economic stability and growth.

How does the Central Bank of Libya manage its reserve assets?

The Central Bank of Libya manages its reserve assets by adhering to international principles and standards, developing exchange rate policies, and ensuring the stability and flexibility of the exchange rate to support the economy.

What technological advancements has the Central Bank of Libya implemented?

The Central Bank of Libya has modernised its information technology systems to provide a deep database, improve the national payments system, and offer advanced IT solutions for secure and efficient banking operations.

How does the Central Bank of Libya develop its research capabilities?

The Central Bank of Libya develops its research capabilities by building a deep economic, financial, and monetary database, supporting research activities, and enhancing transparency and disclosure in data.

How can one open a bank account in Libya?

Opening a bank account in Libya is straightforward, with foreign residents typically needing to provide residency papers and a passport. Additionally, Libyan banks offer the option to hold accounts in various currencies, including Libyan Dinar (LYD), US Dollar (USD), and Euro (EUR), providing flexibility for expatriates and businesses operating in multiple countries.

Can non-residents open bank accounts in Libya?

Yes, non-residents can open bank accounts in Libya. The process typically requires the submission of identification documents such as a passport and proof of residency. The Central Bank of Libya supports non-resident banking services, making it accessible for international clients.

Does Libya adhere to the Common Reporting Standard (CRS)?

As of 10 of June 2024, Libya is not currently a participant in the Common Reporting Standard (CRS), an international standard for the automatic exchange of financial account information developed by the Organisation for Economic Co-operation and Development (OECD).

Is Libya compliant with the Foreign Account Tax Compliance Act (FATCA)?

As of 10 of June 2024, Libya is not compliant with the Foreign Account Tax Compliance Act (FATCA) implemented by the United States. FATCA requires foreign financial institutions to report information on financial accounts held by U.S. taxpayers to the IRS.

What are the benefits of offshore banking in Libya?

Offshore banking in Libya offers several advantages, including financial privacy, competitive interest rates, and flexibility in managing multi-currency accounts. The Central Bank of Libya supports a range of services that cater to international clients, making it an attractive destination for offshore banking activities.

Is it possible to open a multi-currency bank account in Libya?

Yes, it is possible to open a multi-currency bank account in Libya. The Central Bank of Libya allows account holders to manage funds in various currencies such as the Libyan Dinar (LYD), US Dollar (USD), and Euro (EUR). This flexibility is particularly beneficial for international businesses and expatriates.

How does Libya ensure financial privacy for offshore accounts?

Libya upholds strict confidentiality standards for financial transactions and account holders. The Central Bank of Libya has implemented robust data protection measures and policies to ensure the privacy of offshore accounts, making it a preferred location for individuals and businesses seeking financial privacy.

What regulatory frameworks govern offshore banking in Libya?

Offshore banking in Libya is governed by regulations established by the Central Bank of Libya. These frameworks are designed to provide a secure and efficient banking environment while maintaining compliance with international standards. However, as of June 10, 2024 Libya is not currently compliant with CRS and FATCA, which can offer additional privacy benefits.

Are there any tax advantages to offshore banking in Libya?

Libya offers a favourable tax environment for offshore banking, with policies that support financial privacy and confidentiality. While the country is working on aligning with international tax reporting standards, current regulations provide certain tax advantages that can be beneficial for international account holders.

How does the Central Bank of Libya support international transactions?

The Central Bank of Libya has modernised its national payment systems to facilitate secure and efficient international transactions. This includes implementing advanced IT solutions and ensuring that financial transfers and banking operations are carried out swiftly and safely.

Detailed Breakdown of Website Sections

In case you still have any questions, for a deeper understanding of the Libyan banking sector, the Central Bank of Libya’s website remains the most authoritative source.

To facilitate your navigation and ensure you can effortlessly locate the information you need, we offer the following key guidance on where to find specific content on the CBL website:

About Us

The “About Us” section offers a detailed view into the bank’s foundational aspects and operational ethos. It is composed of the following subsections:

- History: This subsection covers the establishment and evolution of the Central Bank of Libya, outlining significant milestones and developments in its history.

- Board of Directors: Information on the current members of the Board of Directors, their roles, and contributions to the bank’s governance.

- Our Mission: This outlines the core objectives and guiding principles of the CBL, focusing on its commitment to monetary stability and economic growth.

- Strategic Plan: Details of the bank’s strategic initiatives aimed at modernising and enhancing its functions and services.

- Governor’s Statement: Messages and statements from the Governor, providing insights into the bank’s current priorities and future direction.

- Careers: Information on employment opportunities, including job listings and application procedures.

Banking Operations

This section delves into the core operational activities of the CBL, covering the systems and processes that ensure secure and efficient banking services. It includes:

- Payment and Settlement: Descriptions of the mechanisms and systems used to process payments and settlements, ensuring smooth financial transactions.

- Market Operations: Information on the bank’s activities within financial markets, including open market operations and interventions.

- Electronic Payment: Details on the infrastructure and services related to electronic payments, highlighting advancements and security measures.

- Banking Supervision: An overview of the regulatory practices and supervisory measures employed by the CBL to maintain stability and compliance within the banking sector.

- Currency Exchange Rates: Current exchange rates and policies governing currency conversion and management.

- Banknotes: Information on the issuance, circulation, and management of Libyan banknotes, including security features and design elements.

Reports & Data

The Reports & Data section provides access to a wealth of financial and economic information through various reports and publications. It includes:

- Economic Bulletin: Regular publications that analyse economic trends and provide insights into the national and global economic environment.

- Monetary and Banking Statistics: Detailed data on the monetary system and banking sector, including metrics on liquidity, reserves, and credit.

- Revenue and Expenditures: Financial reports detailing the bank’s revenue streams and expenditure patterns.

- Annual Reports: Detailed documents summarising the bank’s activities, financial performance, and strategic initiatives over the year.

- Indicators of Banking Sector: Key performance indicators that offer a snapshot of the health and stability of the banking sector.

- Consumer Price Index: Data tracking changes in the price level of a basket of consumer goods and services, indicating inflation trends.

- Balance of Payment: Reports on the country’s balance of payments, reflecting economic transactions with the rest of the world.

- Banks’ Uses of Foreign Exchange: Information on how banks utilise foreign exchange reserves.

- Periodic Letters: Regular communications from the CBL on various financial and economic matters.

- Supervisory Reports: Insights into the supervisory activities conducted by the CBL to ensure regulatory compliance.

- GDP Statistics: Data on the gross domestic product, providing a measure of economic performance.

- International Cooperation Papers: Documents detailing Libya’s economic cooperation with international bodies and other nations.

- Statistical Handbook: A compilation of various statistical data related to the financial and economic sectors.

- Foreign Trade Statistics: Data on Libya’s foreign trade activities, including imports and exports.

- Research and Studies: In-depth research papers and studies on economic and financial topics conducted by the CBL.

Policies

The Policies section outlines the regulatory and operational guidelines that govern the CBL’s activities. It includes:

- Monetary Policy: Framework and strategies for managing the supply of money and interest rates to achieve macroeconomic objectives.

- Exchange Rate Policy: Guidelines on how the CBL manages the exchange rate of the Libyan dinar against other currencies.

- Information Security Policy: Protocols and measures in place to ensure the security and confidentiality of financial information.

- Governance Manual (PDF): Document detailing the governance standards and practices of the CBL.

- Electronic Clearing Guide: Procedures and standards for electronic clearing processes within the banking system.

Legislations

This section provides access to legal and regulatory documents that govern the operations of the CBL and the financial sector. It includes:

- Laws: Detailed listing of the legal frameworks and banking laws that regulate the financial sector.

- Publications: Official documents, guidelines, and regulatory publications issued by the CBL.

Media Center

The Media Center offers a range of multimedia content related to the CBL. It includes:

- News: Updates and announcements regarding the bank’s activities and policy changes.

- Gallery: A collection of images and photos documenting the bank’s events and initiatives.

- Videos: Video content that provides insights into the bank’s operations and public communications.

- Masaref Newspaper: Regular publications and newsletters that offer detailed insights into the bank’s activities and financial news.

Conclusion

The Central Bank of Libya (CBL) remains a pivotal entity in the nation’s financial architecture, navigating complex political and economic landscapes with strategic precision. Amidst the collapse of state structures and persistent instability, the CBL has maintained a crucial role in fostering economic stability and implementing strategic initiatives to support growth.

As of June 2024, the bank’s reserves stand at over 86 billion US dollars, reflecting its capacity to manage and safeguard national financial resources.

The CBL’s actions in monetary policy, financial supervision, and economic research are instrumental in shaping Libya’s financial sector, ensuring resilience and functionality in an unpredictable environment.

The institution’s ability to sustain operations and maintain substantial reserves highlights its significance in the broader economic framework of Libya.